You can learn everything about trading. This is the eight chapter of the Beginner Course, we are

going to talk about Basic knowledge of the Trends.

In this chapter, you will learn about:

- Basic knowledge about Trends

- How to trade using Trends

- Trend Movement

- What is Trend over Time Frames

- Basic knowledge of Support and Resistance

INTRODUCTION TO THE TRENDS

Chart Reading can be classified in the

technical analysis is the next natural step

available after you have conducted your

fundamental analysis.

Fundamental analysis helps you

determine whether you should trade a

particular currency pair. Technical

analysis helps you determine when you

should buy or sell that currency pair.

Many traders consider technical analysis

to be somewhat of an art form that

anyone can master with a little time and

practice.

To get started, focus on becoming

comfortable with the following

foundational concepts of technical

analysis:

TRADING WITH THE TREND

The key to making money in Forex is

identifying trends and trading with it.

Trends tell you where prices will most

likely be going in the future.

If the trend of a currency pair is pointing

up, you need to buy the currency pair to

make money.

If the trend of a currency pair is pointing

down, you need to sell the currency pair

to make money.

If the trend of a currency pair is pointing

sideways, you either need to alternate

between buying and selling or wait until

the trend points up or down to make

money.

Whatever you do, never fight the trend.

CHARACTERISTICS OF THE TREND

Trends do not move straight up or

straight down.

They usually move in one direction for a

while and then retrace part of the

previous movement before turning back

around and resuming the previous

direction.

Every time a currency pair turns around

and begins moving in the opposite

direction, it forms a new high or a new

low.

Identifying these highs and lows allows

you to identify whether a currency pair is

in an uptrend, a down trend or a

sideways trend.

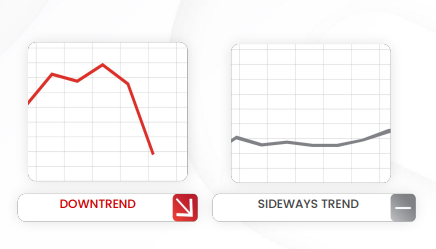

TREND MOVEMENT

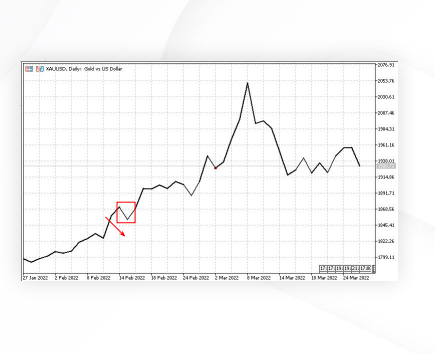

Up trends

Currency pairs that are

trending upward form

a series of higher highs

and higher lows.

Down trends

Currency pairs that are

trending downward form

a series of lower highs

and lower lows.

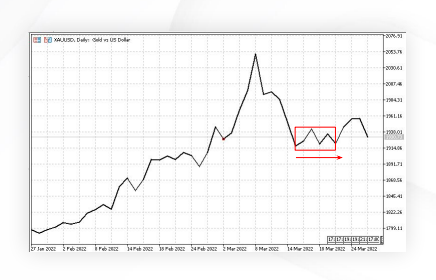

Sideways trends

Currency pairs that are trending

sideways form a series of highs that are at approximately the same price level and a series of lows that are at approximately the same price level.

TRENDS OVER TIME FRAME

Whether they are up trends, down trends

or sideways trends can form over various

time periods.

Identifying the following trends over each

time frame and being able to align them

in your analysis is crucial to your success

as a Forex investor:

- Long-term trends

- Intermediate trends

- Short-term trends

- Aligning trend time frames

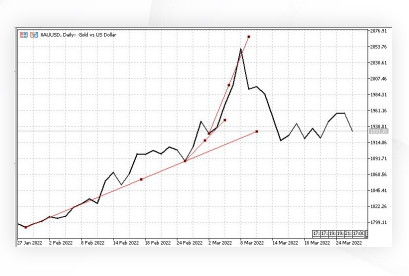

LONG-TERM TREND

Long-term trends, sometimes called

major trends are those trends that have

dominated a currency pair for the longest

period.

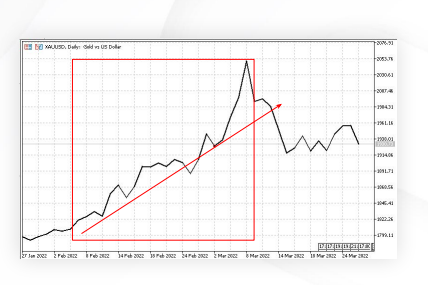

Looking at this chart of the XAUUSD, you

can see that the currency pair has been

rising in an uptrend from left to

right—notice the series of higher highs

and higher lows as time progressed.

Seeing this price action should give you a

bias toward buying the XAUUSD. If the

currency pair had been in a long-term

a downtrend, you would have a bias toward

selling the XAUUSD.

INTERMEDIATE TREND

Intermediate trends, sometimes called

minor trends are more responsive than

long-term trends because they cover

a shorter period of time.

The currency pair was in a sideways

the intermediate trend during the highlighted

time frame—notice the series of level

highs and level lows as time progressed.

Notice that while the intermediate trend

was moving sideways, the long-term

trend was still moving upward.

Trends tend to move in a stair-step

fashion. Rarely do they move straight up

or straight down.

SHORT-TERM TREND

Short-term trends, sometimes called

micro-trends are more responsive than

both long-term trends and intermediate

trends because they cover the shortest

period of time.

These trends are the most volatile

trends and are predominantly affected

by the news of the day.

It is not uncommon to see these

short-term trends change direction

extremely rapidly.

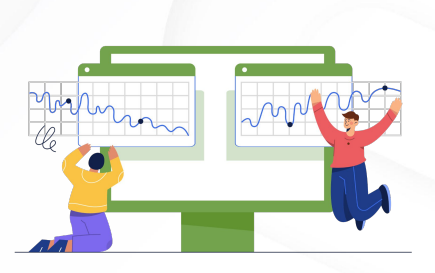

ALIGNING TREND TIME FRAMES

Your most profitable trading

opportunities will come when the

long-term, intermediate and short-term

trends are all lined up in the same

direction.

It is an excellent time to buy the currency

pair, when the long-term, intermediate

and short-term trends are all moving

higher.

When the long-term, intermediate and

short-term trends are all moving lower, it

is an excellent time to sell the currency

pair.

SUPPORT & RESISTANCE CONCEPTS

You will increase your trading profitability

if you can accurately identify levels of

support and resistance—areas where

prices may stop and turn around in the

future.

Resistance is a price level at which a

currency pair tends to stop moving up

and then turns around and starts moving

back down.

Support is a price level at which a

currency pair tends to stop moving down

and then turns around and starts moving

back up.