You can learn everything about trading. This is the seventh chapter of the Beginner Course, we are going to talk about the basic knowledge of Chart.

In this chapter, you will learn about:

- Basic knowledge about Chart

- Charting Basic Concept

- Types of Chart

INTRODUCTION TO THE CHARTING BASICS

Charts are Forex traders’ best friends. As a Forex trader, you will most likely utilize your price charts more than any other available tool.

Since chart are going to play such a large part in trading, it is imperative traders become familiar and be comfortable with charts.

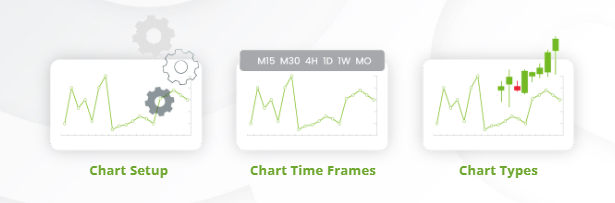

Charting Basics Concept, as follows:

Traders have the flexibility to choose which time frame is the best.

CHART SETUP

The X axis

Runs horizontally along the bottom of the chart providing a timeline for everything that has happened on the chart. The most recent price action is shown on the right side of the chart and the most distant price action is shown on the left side of the chart.

The Y axis

Runs vertically along the right side of the chart providing a price scale for the price movement on the chart. Lower prices are shown toward the bottom of the chart and higher prices are shown toward the top of the chart.

When traders put the two axes together, you can see at what price a currency pair was trading at a particular time in the past.

CHART TIME FRAMES

Charts give the ability to analyse the price

movement of traders favourite currency

pair anywhere from a minute-by-minute

basis to a month-by-month basis.

If you are a shorter-term trader, you will want to use shorter time frames for your charts. You would most likely want to be watching a 1-minute or a 5-minute chart.

If you are a longer-term trader, you will want to use longer time frames for your charts and watch an hourly or a daily chart.

CHART TYPES

Charts give you the ability to analyze the

the price movement of your favorite

currency pair in various formats, from

line charts to candlestick charts.

Technical analysis is a visual, skill that

traders develop, and different traders like

to practice their art on different types of

charts. Some traders feel they can see

and analyze support and resistance levels

better on a line chart, while other traders

feel they get more information on price

movement on a bar chart or a candlestick

chart.

Three Chart Types:

Traders have the flexibility to choose which format is the best.

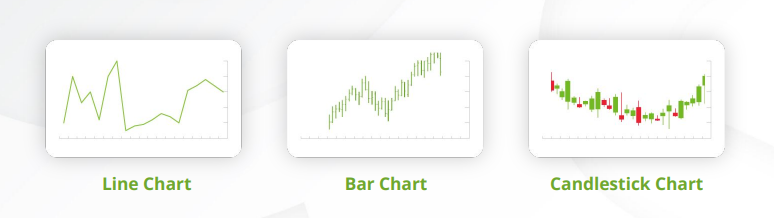

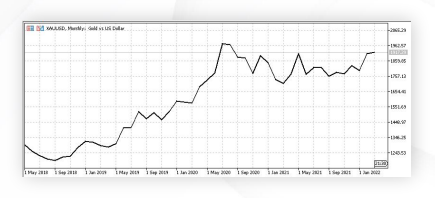

LINE CHART

Line charts are the most basic type of

chart. Technical analysts often use line

charts to easily identify support and

resistance levels.

Line charts only have basic information

plotted on the chart, which means there

is not a lot of other “clutter” to get in the

way of your analysis.

Traders create a line chart by plotting the

closing price of each trading period on a

chart and then connecting each closing

price with a line

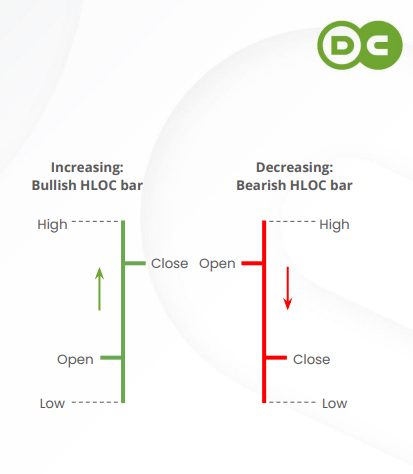

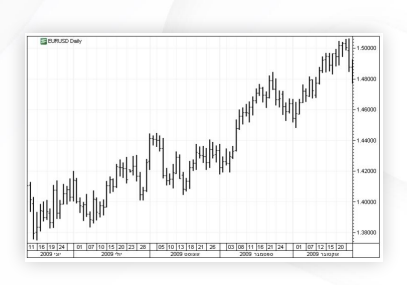

BAR CHART

Bar charts provide more information than

a line chart.

Technical analysts often use bar charts to

know about how a currency pair price

moved up and down during each trading

period.

Whereas line charts only plot the closing

price from each trading period, bar charts

plot the opening, high, low and closing

prices from each period. Each bar

represents one trading period.

To create a bar, plot the high and low

price of a trading period and connect

them with a vertical line.

Next, plot the opening price out to the

left side of the vertical line and connect

that point to the vertical line with a

horizontal line.

Last, plot the closing price out to the right

side of the vertical line and connect that

point to the vertical line with a horizontal

line.

Seeing where a currency pair started the

trading period compared to where it

ended, it will identify trends.

If the price closes higher than it opened,

investors were bullish on the currency

pair during the trading period.

If the price closes lower than it opened,

investors were bearish on the currency

pair during the trading period.

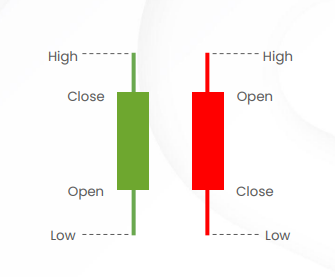

CANDLESTICK CHARTS

Candlestick charts provide the same

information as bar charts but in a slightly

different format.

Technical analysts often use candlestick

charts instead of bar charts because it is

easier to see and identify various trading

patterns using candlestick charts.

Each candlestick represents one trading

period.

Seeing where a currency pair started the

trading period compared to where it

ended the trading period can help you

better identify trends.

If the price closes higher than it opened,

you know investors were bullish on the

currency pair during the trading period.

If the price closes lower than it opened,

you know investors were bearish on the

currency pair during the trading period.